- Dogecoin Price Vs. Bitcoin Halving: Previous Cycle Moves Show What To Expect Next For DOGE

- How would a federal bitcoin reserve work?

- Tether shifts $780M in Bitcoin to reserve — its biggest move in 9 months

- Nation-state Bitcoin adoption to drive crypto growth in 2025: Fidelity

- Key Indicators To Navigate The 2025 Market Cycle

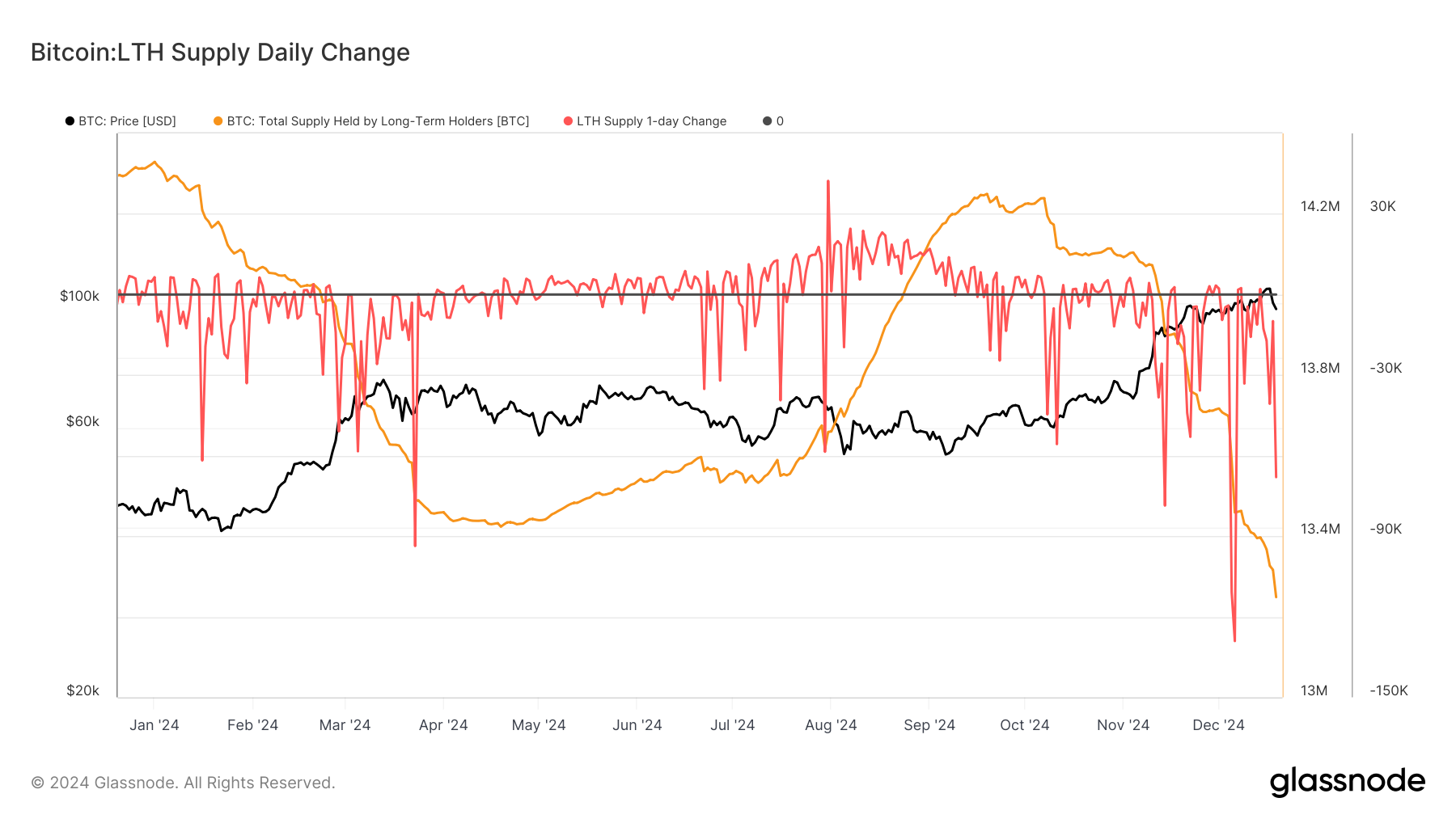

Bitcoin investors could suffer a turbulent quarter, as two opposing Trump crypto trades come into conflict. The price of bitcoin is heading for its worst week since September after concerns about President-elect Trump’s tariff plans, plus the latest stronger-than-expected payroll numbers, caused a spike in bond yields, boosting the dollar while pressuring bitcoin and other risk assets. Although the postelection crypto rally had fizzled by the end of 2024, investor sentiment was still optimistic coming into 2025. The promise of a pro-crypto Congress and White House outweighed any concern about macroeconomic-related speedbumps. Drop first, then rebound But as investors start to make sense of what Trump’s first 100 days could look like, it’s becoming clearer that the bitcoin price could drop further before attempting its next record. A pro-crypto government under Trump may continue to support the digital asset class this year, but other aspects of his agenda could actually work against prices in the near term. “Bitcoin’s problem at the moment is the strong dollar,” said Zach Pandl, head of research at Grayscale Investments. “Part of it is the signal that we got from the Federal Reserve, that they’re going to be slower on rate cuts … but I would attribute the drawdown in the last two days largely to the market starting to appreciate that not every aspect of the Trump policy agenda is going to be positive for bitcoin – and tariffs do introduce some new uncertainty.” At the beginning of the week, bitcoin responded favorably to a Washington Post report that the scope of the Trump administration’s tariff plans might be limited. Two days later, however, Trump was reportedly contemplating the use of emergency measures to implement wide-reaching tariffs. The dollar gained against most other currencies, and appreciated further when Treasury yields touched 14-month highs Friday. “Since the Federal Reserve did its hawkish cut in December, risk takers have been jumpy and sensitive to hot data on jobs, services, and prices,” said Alex Thorn, head of research at Galaxy Digital. “Couple that with uncertainty about President-elect Trump’s forthcoming trade and tariff agenda, and it’s possible risk assets will face choppiness over the near term, despite long-term structural tailwinds for bitcoin and digital assets remaining intact.” Bitcoin’s correlations with stocks and gold tend to fluctuate, but it has two more persistent historical correlations: a positive one with global liquidity ( measured by M2 , a gauge of broad money supply), and a negative one with the dollar index. H.C. Wainwright crypto and blockchain analyst Mike Colonnese noted last week that M2 has been trending lower since October and that could lead to bitcoin retracing to the mid-$70,000 range sometime in the current quarter. Analysts like JPMorgan’s Kenneth Worthington have also pointed out that the legislative process on Capitol Hill is slow, and any positive policy impact may not be felt until the end of the year. “Especially over the next three months, when Congress is going to be dealing primarily with non-crypto issues, it’s going to be a more macro driven market,” Pandl at Grayscale said. “Eventually we’re going to get to crypto legislation on stablecoins and market structure – we should feel confident that this Congress is going to take up those issues – but there are big ticket items that need to be dealt with first,” like immigration, taxes and tariffs, he said. Bitcoin soared more than 45% in the month after the Nov. 5 presidential election, helped by Trump’s pro-crypto promises and the industry spending millions of dollars to help elect the most pro-crypto Congress ever, before sliding in December. “The idea that we’re going to have a pro-crypto Congress and a pro-crypto legislative environment and that’s going to be quite supportive for the asset class – I very much believe that,” Pandl added. “But aspects of the Trump agenda can also be positive for the dollar [and] introduce risk to markets, and tariffs are really the key example of that.”

Bạn đang xem: Two Trump crypto trades are in conflict and could derail the bitcoin rally

Nguồn: https://rentersinsurance.cyou

Danh mục: News