- Micheal Saylor hints at another Bitcoin purchase as holdings reach 447,470 BTC

- Trump-linked Strive files for ‘Bitcoin Bond’ ETF

- Bitcoin Primed To Be One of the Best-Performing Assets in 2025, Says Fundstrat’s Tom Lee – But There’s a Catch

- This is when Arthur Hayes says Bitcoin’s price will peak – DL News

- Michael Saylor Unveils New Bitcoin Framework to Boost The US Leadership In Crypto

This is a published version of our weekly Forbes Crypto Confidential newsletter. Sign up here to get Crypto Confidential days earlier free in your inbox.

Bạn đang xem: Cryptos Surrender Recent Gains, DOJ Cleared For $6.5 Billion Bitcoin Sale

Getty Images

CRYPTO ASSETS SLIDE ON FED SIGNALS, ROBUST JOBS DATA

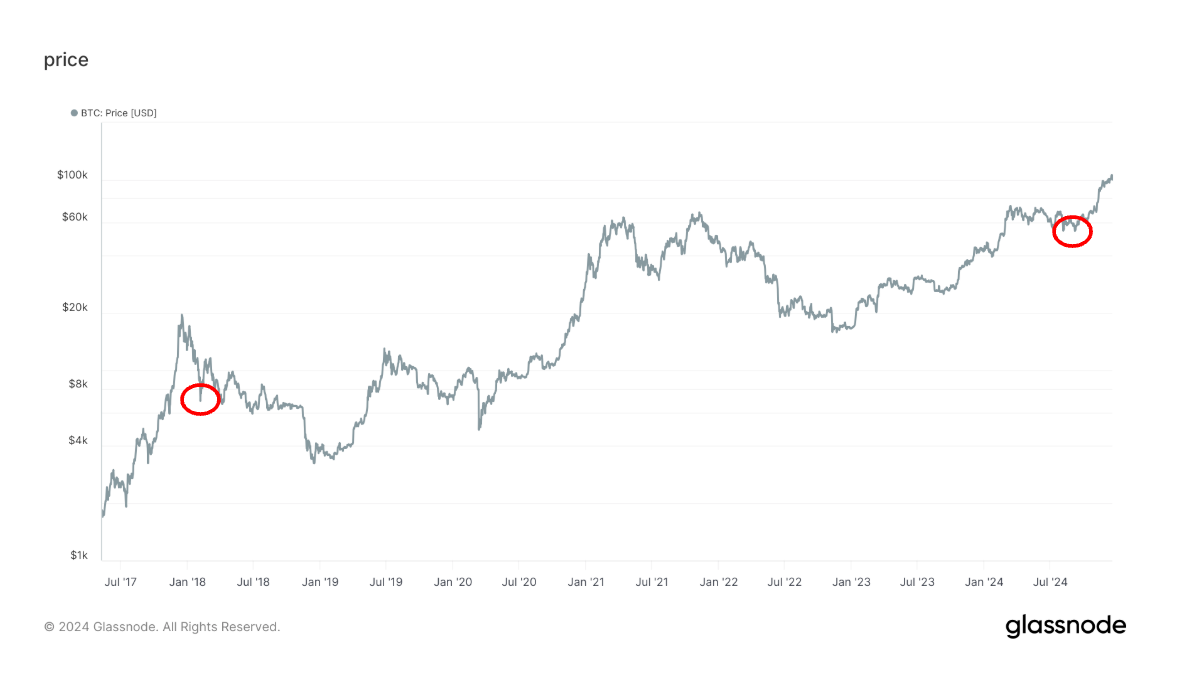

Digital assets faced a tough week, with bitcoin dropping 3.6% to $94,778 on Friday as markets digested hawkish signals from the Federal Reserve and stronger-than-expected U.S. employment data. Ether fared worse, tumbling 9.3% to $3,268.

Minutes from the Federal Reserve’s late December meeting, released Wednesday, revealed officials are likely to take a cautious approach to interest rate cuts in 2025, citing ongoing inflation concerns.

Xem thêm : Nation-state Bitcoin adoption to drive crypto growth in 2025: Fidelity

A surprisingly strong U.S. jobs report added to the pressure: the Labor Department reported 256,000 new positions in December, far exceeding economists’ projections of 160,000, while unemployment ticked down to 4.1%.

U.S. GOVERNMENT CLEARED TO SELL $6.5 BILLION IN BITCOIN

The Department of Justice (DOJ) has received court approval to liquidate its largest-ever cryptocurrency seizure—69,370 bitcoin worth approximately $6.5 billion—tied to the infamous Silk Road marketplace. A federal judge’s December 30 ruling dismissed an attempt by Nevada-based Battle Born Investments Company to block the sale.

While the court decision does not mandate an immediate sale, precedent suggests the U.S. Marshals Service could proceed with a structured auction process as it routinely does with seized assets.

The timing is notable: the decision comes just days before President-elect Donald Trump’s administration takes office. Trump has previously proposed creating a strategic bitcoin reserve and pledged to retain all government-seized cryptocurrency. At a bitcoin conference last year, he stated the intention to preserve 100% of government-held bitcoin.

THE DAWN OF CRYPTO’S GOLDEN AGE?

Xem thêm : How Bitcoin Became Boring – The Atlantic

Another rollercoaster year in crypto is behind us, but 2025 is already shaping up to be even more transformative. A surge of post-election optimism, coupled with President-elect Donald Trump’s pledge to make the U.S. the “crypto capital of the world,” has catapulted bitcoin past $100,000.

The incoming administration is being hailed as potentially the most pro-crypto in history. A wave of public crypto listings is expected, and stablecoins are on track to double their market cap to $400 billion—if long-anticipated U.S. stablecoin legislation becomes a reality. The newest frontier is AI agents + crypto—programs that can, in theory, trade tokens, manage assets, and even hustle on social media. Read more about what 2025 could bring.

Also: Why An Old-School Value Investor Is Betting On Bitcoin

ELSEWHERE:

Crypto CEOs Clamor For Access To Trump As Inauguration Day Nears [Bloomberg]

CFTC Chairman To Step Down When Trump Takes Office [The Wall Street Journal]

Coinbase Scores Win Against SEC As Judge Agrees To Escalate Dispute Over Crypto Security Definition [Fortune]

Nguồn: https://rentersinsurance.cyou

Danh mục: News