- Bitcoin Surges To A New All-Time High: Critics And Skeptics Still Linger

- Crypto Boom Looming? Get Bitcoin ETF BRRR

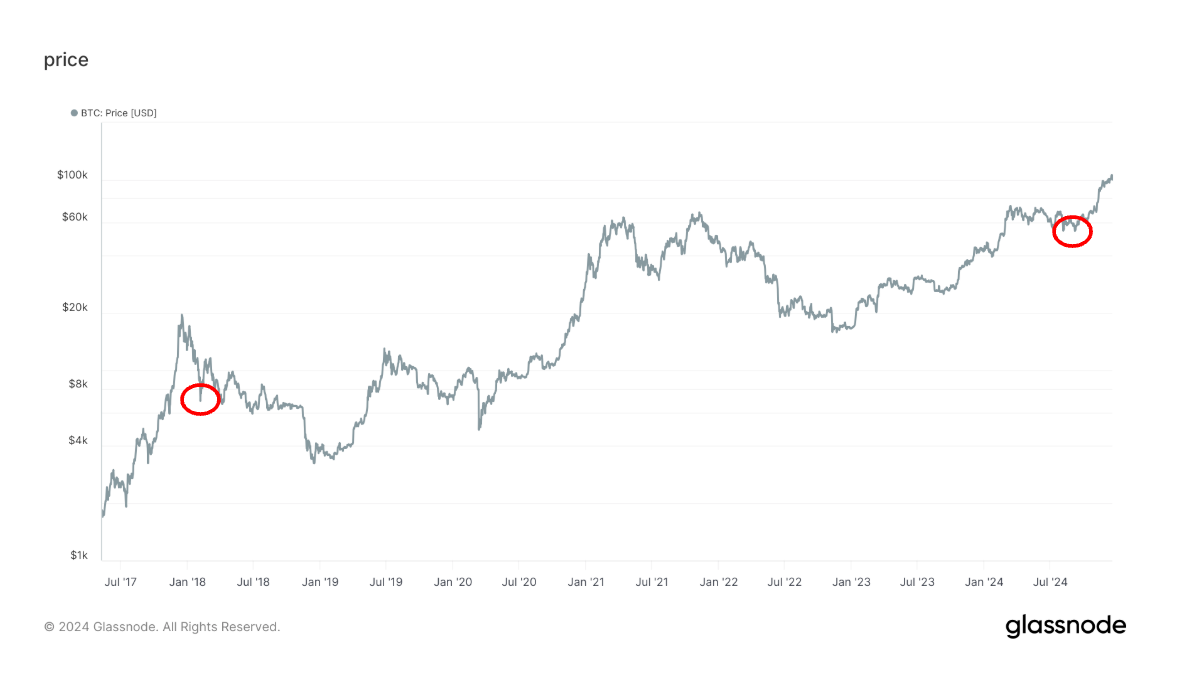

- Bitcoin’s $100K milestone reflections, what’s next

- KULR Technology Makes Bold $21M Bitcoin Investment, Acquires 217 BTC at $96.5K Average

- This Crypto Sector Could Rally by up to 5x in 2025 and Outperform Bitcoin, Ethereum and Solana, Says Analyst

It may feel like ages ago in a fast-paced crypto industry, but this year’s launch of spot ETFs for Bitcoin and Ethereum—in January and July, respectively—ushered in a seismic shift for the crypto industry.

Bạn đang xem: The Year in Crypto: Bitcoin and Ethereum ETFs Bring More Investors Into Crypto

BlackRock enters the chat

Xem thêm : Bitcoin Lull Could Spur Altcoin Rally, With $90K Considered “Attractive”

As of this writing, it ranked 32nd among all U.S. ETFs by AUM, according to the ETF Database.

A different market

Grayscale’s gulch

Xem thêm : Is Bitcoin Dominance About To Give Way To Altseason? Analysts React

While billions of dollars flowed out of GBTC this year—$21 billion, as of this writing—Grayscale’s then-CEO Michael Sonnenshein said the outflows were anticipated. In April, he pointed to the bankruptcy estates of collapsed crypto firms, which were “forced” to liquidate GBTC holdings, among traders capitalizing on GBTC’s once-sizable discount due to its former structure.

Ethereum and beyond

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Nguồn: https://rentersinsurance.cyou

Danh mục: News