- Craig Wright Sentenced To 1 Year In Prison: The Self-Proclaimed Bitcoin Creator Faces Justice

- Bitcoin Mining Giant MARA Gobbles Up $1,530,000,000 Worth of BTC As Fellow Miners Add to Crypto Treasuries

- Bitcoin (BTC) May Be Due for Significant Correction As Technical Indicators Overextend: Benjamin Cowen

- How Ohio is Leading the Charge in the United States

- Here’s Why Bitcoin (BTC) Might Experience Another Correction Soon

“I think that’s a ridiculous number.”

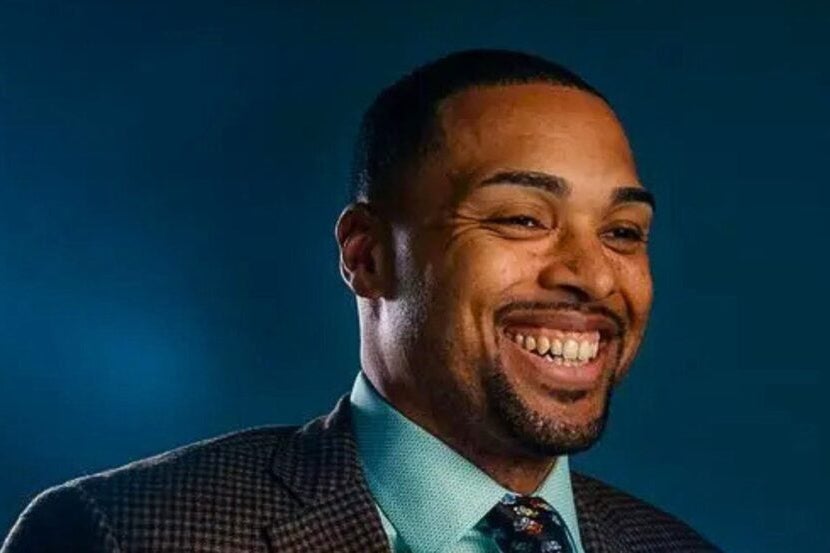

Bạn đang xem: ‘Most Crypto-Foward’ RIA Slams Bitcoin Forecasts From Michael Saylor, Others: ‘Disvalues It To Me’

Tyrone Ross Jr. of 401 Financial didn’t mince words when it comes to the hysteria around Bitcoin BTC in the lead up to $100,000. What really struck him was some of the price targets thrown around by Microstrategy MSTR exec Michael Saylor, among others, who floated the idea that the price per Bitcoin at $13 million was within reach for the largest cryptocurrency by market value.

Saylor’s predictions were among a plethora floated in recent months. From Wall Street analysts at Bernstein and Ark Invest’s Cathie Wood to SkyBridge Capital’s Anthony Scaramucci, who earlier this year called for Bitcoin to reach anywhere from $150,000 to $200,000 in the next 12 months to $1 million within a couple of years.

“I wish we could all have his conviction,” Ross laughed, in reference to Saylor’s call for an even more ambitious price point.

Xem thêm : Investor Anthony Pompliano Says 2025 Will Be a ‘Great Year’ for Bitcoin – Here Are His Reasons

That surprise is saying something. Ross describes himself as the “most crypto-forward RIA” in the country with a heavy bias towards Blockchain technologies and bitcoin. Ross has advocated for crypto inclusion in clients’ portfolios going back nearly 10 years, but still finds this external commentary unsettling – though in the most positive way.

“I’m not in it for $100,000, I’m not in for $13 million. If bitcoin reached $13 million I’d be disappointed,” Ross told Benzinga’s Chief Content Officer Brad Olesen in an exclusive interview, implying he’d expect the price to rise even further over time. “Putting a number” on Bitcoin is “disvaluing it to me,” he said. “I would never put a price target on it because it is the ‘greatest flashlight and clock’ ever created.”

Also Read: Ethereum Price Soars Past $4,000: What Is Going On With ETH?

Tyrone’s existential view about what the Blockchain and bitcoin can do for payment rails and “inequities” echoes what more and more voices are starting to relay about what cryptocurrency could represent.

Fed Chairman Jerome Powell, in his latest public remarks, compared bitcoin to “digital gold,” in an indication that it can be more than just electronic 0s and 1s or used exclusively for illicit activity. Gold has utility as an input in electronics, is often cited as a valuable tool to protect against inflation, is considered a safe haven asset, and a way to diversify one’s portfolio.

Despite the futility of putting a number on Bitcoin – “price predictions are silly to me,” Ross added – it hasn’t stopped the cascade of analysts and ETF issuers from providing their views going into 2025. Van Eck put targets on bitcoin, ethereum ETH/USD and solana SOL/USD just last week, among a host of other forecasts, including Donald Trump‘s incoming administration’s stance on policy in the sector.

Read Next:

Photo courtesy of 401 Financial.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nguồn: https://rentersinsurance.cyou

Danh mục: News