- Bitcoin Surges Past A Critical Market Indicator, A Major Run On The Horizon?

- Federal Reserve to Own Bitcoin? Lummis Proposes Change

- Wondering When To Sell Your Bitcoin? Crypto Analyst Gives Exact Figure For 2025

- Donald Trump will do something ‘crazy’ or ‘something great’ with bitcoin strategic reserve policy

- Metaplanet Stock Tanks After It Converts Bitcoin Treasury to New Business Line

- Founder and chairman Michael Saylor gobbles up Bitcoin.

- MicroStrategy has almost doubled its Bitcoin holdings in six months.

- The software company is now part of the Nasdaq 100.

Michael Saylor, founder and chairman of MicroStrategy, is Christmas’ most predictable gift giver.

Bạn đang xem: MicroStrategy goes on $11bn holiday shopping spree in record Bitcoin binge – DL News

All he ever does is buy Bitcoin.

On Monday, his publicly-traded software company announced that it had acquired more than 5,000 of the cryptocurrency.

That caps a frenetic holiday shopping spree.

MicroStrategy has gobbled up about 113,000 Bitcoins since mid-November, according to filings with the Securities and Exchange Commission.

Xem thêm : Bitcoin Preparing For Its Next Major Market Surge – Here’s How High It Will Go

At current prices, that’s about $11 billion.

Microstrategy’s buying spree from mid-November to December is its largest month-long splurge on record.

The company’s Bitcoin treasury now numbers more than 444,000 Bitcoins, or about $44 billion.

Join the community to get our latest stories and updates

Nasdaq 100

MicroStrategy’s substantial Bitcoin purchases come as the firm has ridden a soaring stock to land in the Nasdaq 100, an index of the largest non-financial companies on the stock exchange.

Since January, its stock price has more than quintupled to now trade at about $360.

It’s a surprising surge for a company whose actual business, selling data analytics software to large enterprise businesses, has taken back seat to its never-ending purchases of Bitcoin.

Traders and Wall Street analysts see the company’s stock as a proxy, which moves in lockstep with Bitcoin’s rises and falls, for the cryptocurrency.

To fund its Bitcoin purchases, MicroStrategy uses surplus cash from its software business as well as equity and debt issuances.

It’s a strategy some analysts have criticised.

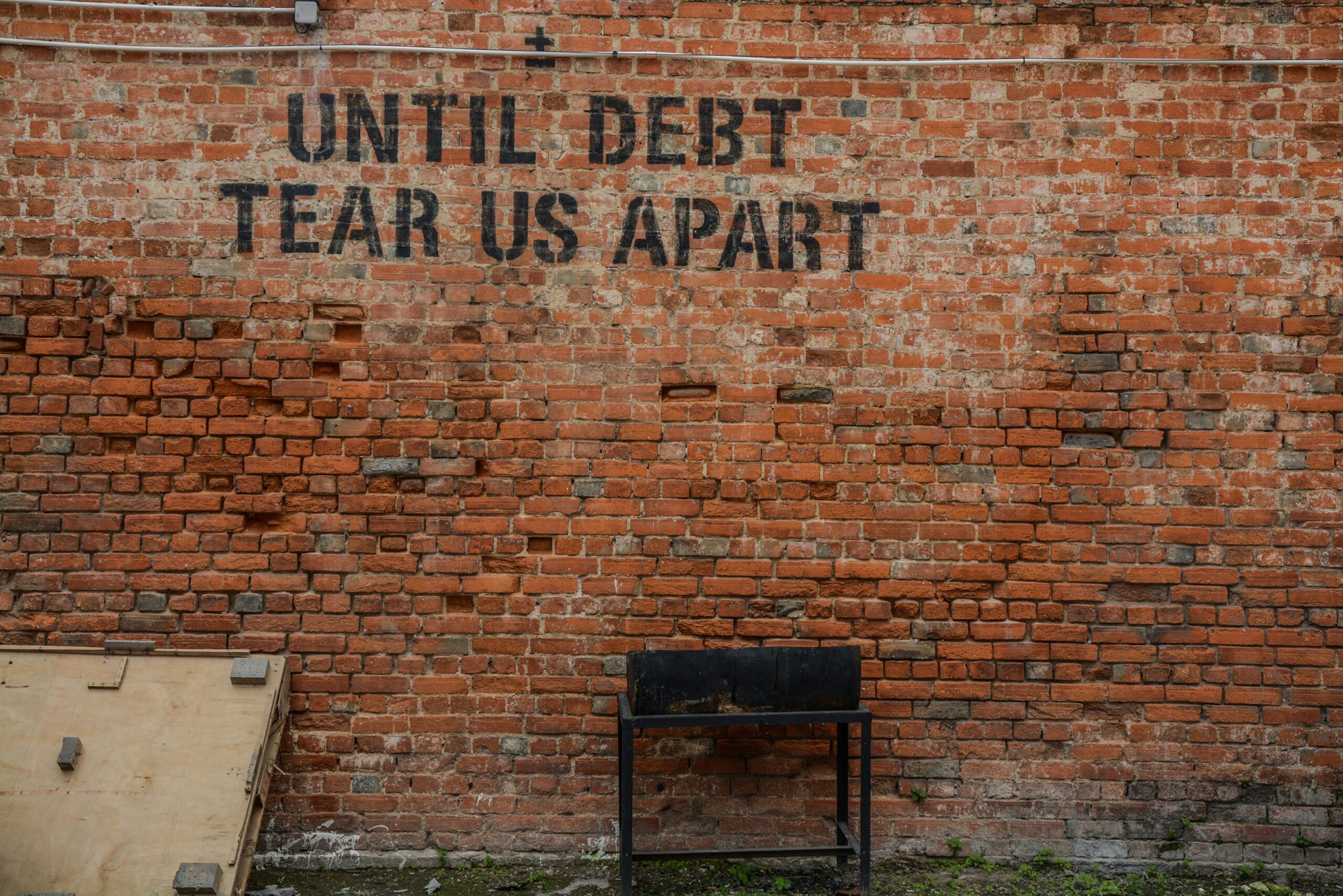

“Eventually, the debt will far eclipse equity, the trading premium will disappear, the conversion prices on the notes will feel unreachable and equity price will collapse under the weight of senior debt, particularly during a gnarly Bitcoin dip,” Tatiana Koffman, author of the “Myth of Money,” recently said on X.

Crypto market movers

- Bitcoin is up 5.1% in the past 24 hours to trade at $98,705.

- Ethereum is also up 3.7% to trade at $3,521.

What we’re reading

Ben Weiss is DL News’ Dubai Correspondent. Got a tip? Email him at [email protected].

Nguồn: https://rentersinsurance.cyou

Danh mục: News