- Japan’s Answer to MicroStrategy Raises $61 Million to Buy More Bitcoin

- Should You Forget Bitcoin and Buy Solana Instead?

- Bitcoin Reserve Proposed By French MEP To Bolster EU

- Is Bitcoin Bottom In? BTC’s Price Action is Inverse of December Peak Above $108K

- Dogecoin Gives Up All of Its 2025 Gains as Bitcoin, Solana Keep Falling

(Bloomberg) — MicroStrategy Inc. bought $243 million of Bitcoin, the 10th consecutive weekly purchase by the enterprise software company turned leveraged Bitcoin proxy.

Bạn đang xem: MicroStrategy Buys $243 Million of Bitcoin After Share Sales

Most Read from Bloomberg

The Tysons Corner, Virgina-based firm now owns over 2% of all the Bitcoin that will ever exist as co-founder and Chairman Michael Saylor ramps up purchases as part of a buy and hold strategy he began in 2020. MicroStrategy owns around $41 billion of the original cryptocurrency.

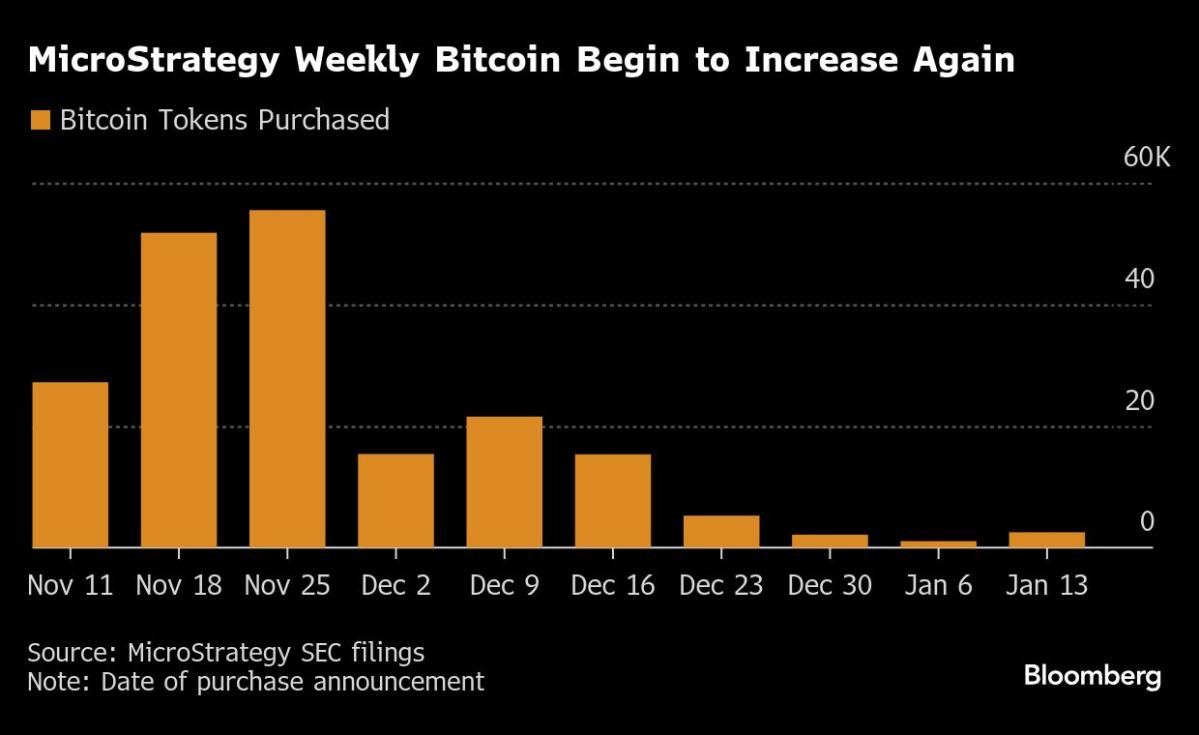

MicroStrategy purchased 2,530 Bitcoin tokens at an average price of approximately $95,972 from Jan. 6 through Jan. 12, according to a filing with the US Securities and Exchange Commission on Monday. The pace of the purchases had slowed in recent weeks.

The so-called Bitcoin treasury company plans to raise $42 billion of capital through 2027 using at-the-market stock sales and convertible debt offerings to purchase additional Bitcoin. MicroStrategy has already surpassed two-thirds of its equity goals less than three months after announcing its plans. It can buy another $6.5 billion of Bitcoin with the proceeds of share sales under the current plan.

Hedge funds have been driving some of the demand as they seek out MicroStrategy for convertible arbitrage strategies by buying the bonds and selling the shares short, essentially betting on the underlying stock’s volatility.

The firm hopes to advance its equity offerings, with a shareholder vote scheduled for Jan. 21 to decide whether to increase the number of authorized shares of its Class A common stock from 330 million to 10.3 billion. MicroStrategy also plans to raise $2 billion through offerings of perpetual preferred stock, which would be senior to its Class A common stock.

Xem thêm : Dogecoin Founder Comments on Bitcoin Price Crash: Details

MicroStrategy shares are up 13% so far this year, closing at $327.91 on Friday, but still well below its all-time high of about $474 in November. Bitcoin has dropped about 3% this year, after rallying 120% in 2024.

(Adds a chart on the purchases.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Nguồn: https://rentersinsurance.cyou

Danh mục: News