- Crypto Longs Record $700M Liquidations as Trump’s Bitcoin Plans Dented

- Bitcoin Prices Reached A Fresh Zenith This Week As Multiple Factors Fueled Gains

- Nasdaq investors set to gain bitcoin exposure

- Craig Wright Found in Contempt of Court Over Bitcoin Creation Claims

- Is The Tide Turning For Bitcoin? Recent Reserves And Netflows Indicate Market Reversal

Bitcoin’s 15% correction during the third week of December marked its largest weekly price drop since August. Experts attribute the decline to the impact of global macroeconomic factors, warning that Bitcoin could see further downside if these pressures intensify.

Bạn đang xem: Bitcoin May Face $20,000 Drop as Global Money Supply Shrinks

However, Bitcoin also has internal factors to counterbalance the negative impact of the macro.

Global Liquidity Plunges Over the Past Two Months

According to The Kobeissi Letter, Bitcoin’s price has historically shown a 10-week lagged correlation with Global Money Supply (Global M2). Over the past two months, Global M2 has fallen by $4.1 trillion, signaling potential further declines in Bitcoin prices if the trend continues.

Xem thêm : Donald Trump will do something ‘crazy’ or ‘something great’ with bitcoin strategic reserve policy

Global M2 is a key economic metric that measures the total supply of money in the global economy, including cash, demand deposits (M1), term deposits, and other liquid assets. Fluctuations in Global M2 often impact both stock and cryptocurrency markets.

“As global money supply hit a new record of $108.5 trillion in October, Bitcoin prices reached an all-time high of $108,000. Over the last 2 months, however, money supply has dropped by $4.1 trillion, to $104.4 trillion, the lowest since August. If the relationship still holds, this suggests that Bitcoin prices could fall as much as $20,000 over the next few weeks.” – The Kobeissi Letter predicted.

A month ago, Joe Consorti, Head of Growth at Bitcoin custody firm Theya, warned of a potential 20%-25% Bitcoin correction based on similar indicators. That forecast appears to be materializing.

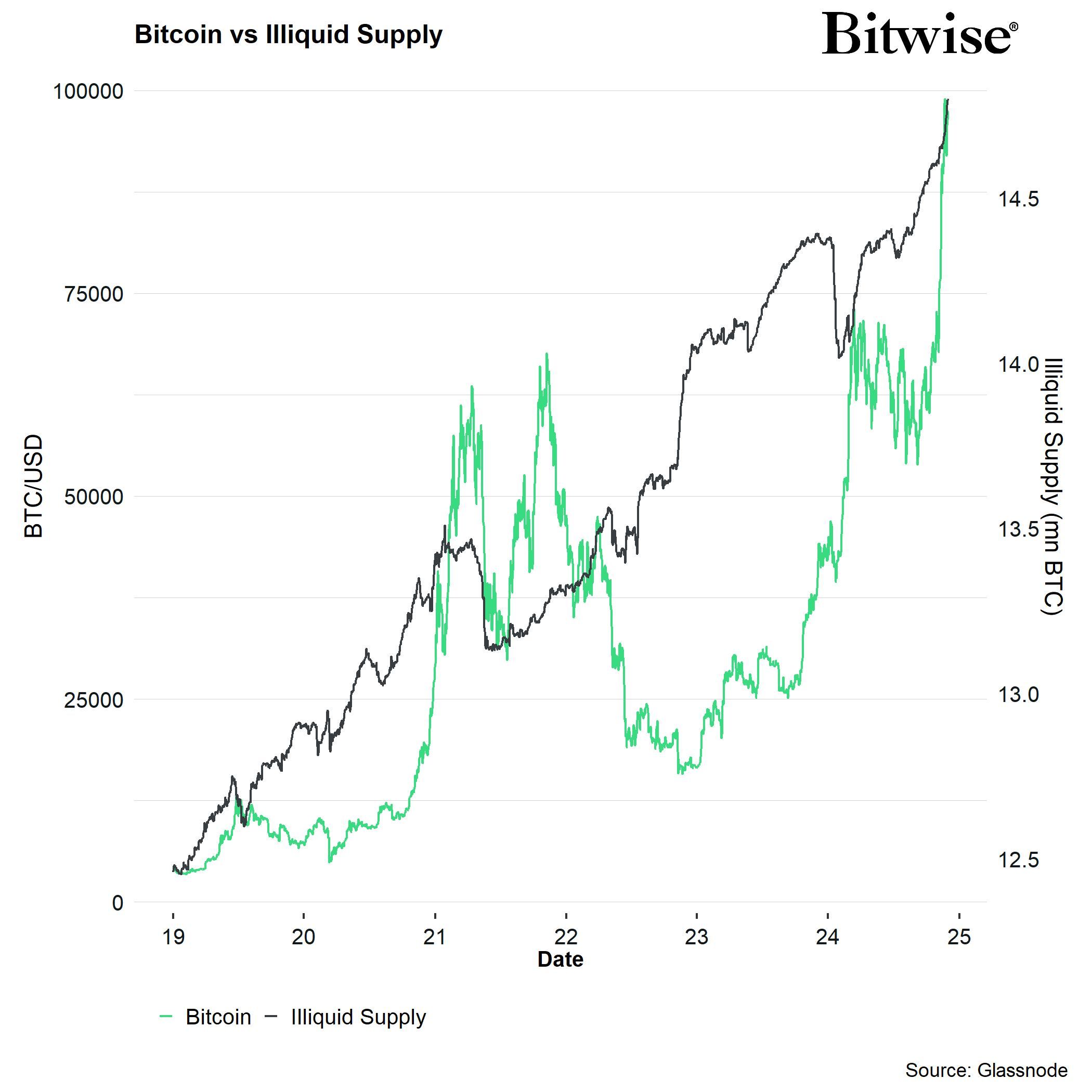

André Dragosch, Head of Research at Bitwise, shares a similar outlook. He anticipates Bitcoin will remain under pressure due to tightening liquidity in the United States. However, he highlights an internal Bitcoin factor that could counterbalance this liquidity squeeze: Bitcoin’s growing illiquid supply.

Xem thêm : Russian Companies Now Using Bitcoin (BTC) for Foreign Trade, According to Finance Minister: Report

A higher illiquid supply indicates increased scarcity of Bitcoin, potentially supporting its price under supply-demand dynamics.

“Bitcoin is currently balancing the prospects of a) increasing macro headwinds stemming from the decline in US and global liquidity and b) ongoing on-chain tailwinds stemming from the strong BTC supply deficit. Eventually bullish on-chain factors will likely trump bearish macro factors but this will likely create some volatility in early 2025 (and possibly some attractive buying opportunities).” – André Dragosch commented.

At press time, Bitcoin is trading around $94,000, with BeInCrypto data showing it has dropped nearly 6% over the weekend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Nguồn: https://rentersinsurance.cyou

Danh mục: News