- Bitcoin drops below $98,000 as Treasury yields pressure risk assets

- Bitcoin Faces Short-Term Pressure Amid Macro and Sentiment Shifts

- Is a Bitcoin Crash Coming in 2025? Experts Weigh In

- If Bitcoin Is Digital Gold — What’s Going On With Real Gold?

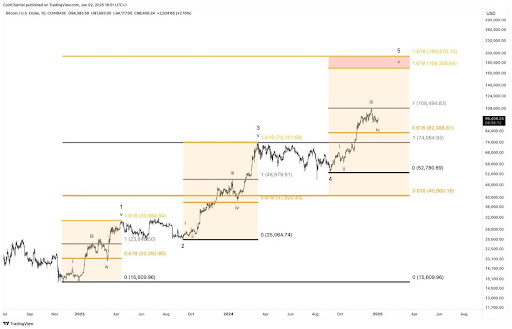

- Bitcoin Bull Cycle End Near? This Pattern Could Say So

U.Today – Mark Zuckerberg, who famously named his pet goat , was proposed to add Bitcoin to Meta (Facebook) holdings.

Bạn đang xem: Shareholders Urge Mark Zuckerberg to Buy Bitcoin for Meta By U.Today

According to podcaster and CEO of Jubilee Royalty Tim Kotzman, a Bitcoin Treasury Shareholder Proposal has been submitted to Meta Platforms Inc (NASDAQ:)., marking a significant development in the adoption of Bitcoin as a corporate asset.

The proposal was filed by Ethan Peck, an employee at The National Center for Public Policy Research, on behalf of his family’s shares. This initiative follows similar proposals submitted by the organization to tech giants like Microsoft (NASDAQ:) and Amazon (NASDAQ:).

The proposal likely advocates for Meta to consider adding Bitcoin to its corporate treasury, aligning with the growing trend of institutional adoption of cryptocurrencies. If successful, this move could further solidify Bitcoin’s role as a mainstream financial asset and a hedge against inflation.

The shareholder proposal submitted to Meta presents a compelling argument for the company to explore adding Bitcoin to its corporate treasury.

Xem thêm : Michael Saylor Unveils New Bitcoin Framework to Boost The US Leadership In Crypto

Ethan Peck, in his supporting statement, outlines the challenges of holding large cash reserves and bonds in an inflationary environment, noting that these assets are diminishing shareholder value over time.

He emphasizes Bitcoin’s superior long-term performance as an inflation-resistant store of value, citing its 124% increase in 2024 and a staggering 1,265% rise over the past five years, vastly outperforming traditional bonds.

Peck also highlights the alignment of Bitcoin adoption with Meta’s innovative ethos, referencing Mark Zuckerberg’s symbolic naming of his goats, “Bitcoin” and “Max,” as well as Meta director Marc Andreessen’s favorable stance on cryptocurrencies.

He underscores that major institutional investors, such as BlackRock (NYSE:), advocate modest Bitcoin allocations, arguing that a similar strategy could benefit Meta’s shareholders.

Peck draws attention to broader trends in Bitcoin adoption, including the rapid growth of BlackRock’s Bitcoin ETF, corporate treasury strategies like MicroStrategy’s and potential government reserves.

The proposal calls on Meta’s board to conduct an evaluation of Bitcoin as a treasury asset, positioning it as an opportunity for Meta to remain a leader in forward-thinking asset management.

Xem thêm : falls to $95k as Fed’s hawkish tilt weighs By Investing.com

This approach, he argues, would honor the company’s tradition of setting technological and financial trends, rather than merely following them.

MicroStrategy still buying Bitcoin

MicroStrategy continues to reinforce its position as Bitcoin’s largest corporate holder, recently acquiring an additional 1,070 BTC for $101 million, according to a regulatory filing.

This marks the company’s ninth consecutive weekly Bitcoin purchase announcement, bringing its total holdings to an astounding 447,470 BTC, currently valued at $44.3 billion.

MicroStrategy has ambitious plans to raise $2 billion through a preferred stock offering, potentially fueling further Bitcoin acquisitions.

With a market capitalization of $93 billion, MicroStrategy now ranks as the 99th largest U.S. company, having leapt 16 spots in a single day. It also became the third most traded equity on Monday, following Tesla (NASDAQ:) and Nvidia (NASDAQ:).

Nguồn: https://rentersinsurance.cyou

Danh mục: News