- Bitcoin Gains Financial Legitimacy as FASB Adopts Fair Value Accounting

- Michael Saylor’s MicroStrategy Announces New Capital Raise Plan of up to $2,000,000,000 To Acquire More Bitcoin

- El Salvador gets IMF $1.4bn deal after scaling back bitcoin bet

- Here’s why Bitcoin, Ethereum, XRP, and other altcoins just crashed

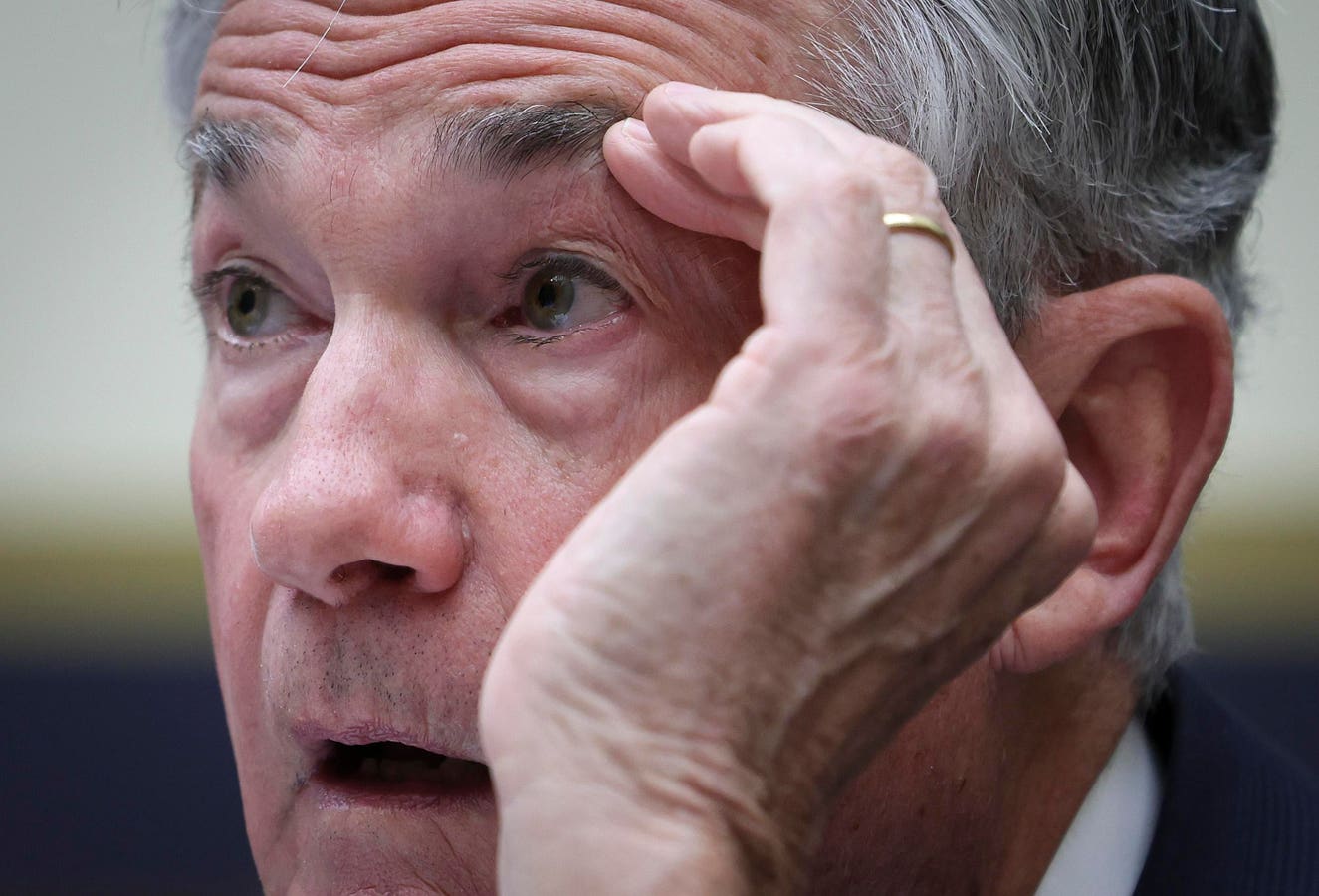

- Hawkish Fed Hammers Cryptos, Bitcoin ETF Exodus

Bitcoin’s (BTC) price outlook remains “structurally bullish” despite temporary headwinds from macroeconomic data, Zach Pandl, Grayscale’s head of research, told Cointelegraph.

Bạn đang xem: Bitcoin’s outlook remains bullish despite macro setback: Grayscale

On Jan. 10, a positive US jobs report sent BTC’s spot price tumbling below $93,000 as the US dollar rose on expectations of slower interest rate cuts.

“Bitcoin seems to be held back by strength in the US dollar, which is rising due to more hawkish Fed policy and the threat of tariffs,” Pandl told Cointelegraph on Jan. 10, adding:

“Today’s strong jobs report reduces the chances of Fed rate cuts, further supports the dollar, and may weigh on the price of Bitcoin temporarily.”

Xem thêm : KULR Technology Makes Bold $21M Bitcoin Investment, Acquires 217 BTC at $96.5K Average

Futures markets now gauge the probability of an interest rate cut in January at less than 3%, according to data from CME FedWatch. The US Dollar Index (DXY) rose nearly 0.5% in morning trading.

“However, with the [US presidential] inauguration right around the corner, this setback may be short-lived,” Pandl said, adding he still sees a “structurally bullish outlook for crypto valuations.”

Crypto returns vs. other asset classes. Source: Grayscale

Related: Grayscale adds AI launchpads, Solana DeFi apps to Q1 2025 top tokens

“Structurally bullish outlook”

On Nov. 5, 2024, Donald Trump prevailed in the US presidential elections. Trump has promised to appoint industry-friendly leaders to key regulatory agencies and make the US “the world’s crypto capital.” He takes office on Jan. 20.

Xem thêm : Bitcoin (BTC) Price to Hit High Near $185K in 2025 as Nations Adopt: Galaxy Research

In December, Grayscale updated its list of top tokens to watch in 2025 to reflect changes, including “the US election and its potential implications for industry regulation.”

Meanwhile, Steno Research expects 2025 to be crypto’s best year ever, with BTC crushing all-time highs as “an unprecedentedly favorable regulatory environment” propels institutional adoption to “unparalleled levels.”

US Bitcoin exchange-traded funds (ETFs) broke $100 billion in net assets for the first time in November, according to data from Bloomberg Intelligence.

Steno expects Bitcoin ETFs to see additional net inflows of $48 billion in 2025.

Surging institutional inflows could cause positive “demand shocks” for Bitcoin, potentially sending BTC’s price soaring in 2025, asset manager Sygnum Bank said in December.

Magazine: Ether may ‘struggle’ in 2025, SOL ETF odds rise, and more: Hodler’s Digest, Dec. 29–Jan. 4

Nguồn: https://rentersinsurance.cyou

Danh mục: News