- Bitcoin Tops $100,000 for First Time in 2025 as Trump Trade Continues to Spur Sentiment

- US selling 69K seized bitcoins could mess with Trump plans for crypto reserve

- How Bitfinex Whales Signal Price Moves

- Bitcoin Slides as Dollar Strength Weighs Down Bulls

- 120% growth! Bitcoin outperformed most asset classes last year — will the momentum sustain for cryptos in 2025?

- Bitcoin price slightly recovers and trades around $94,700 on Friday after declining nearly 6% earlier this week.

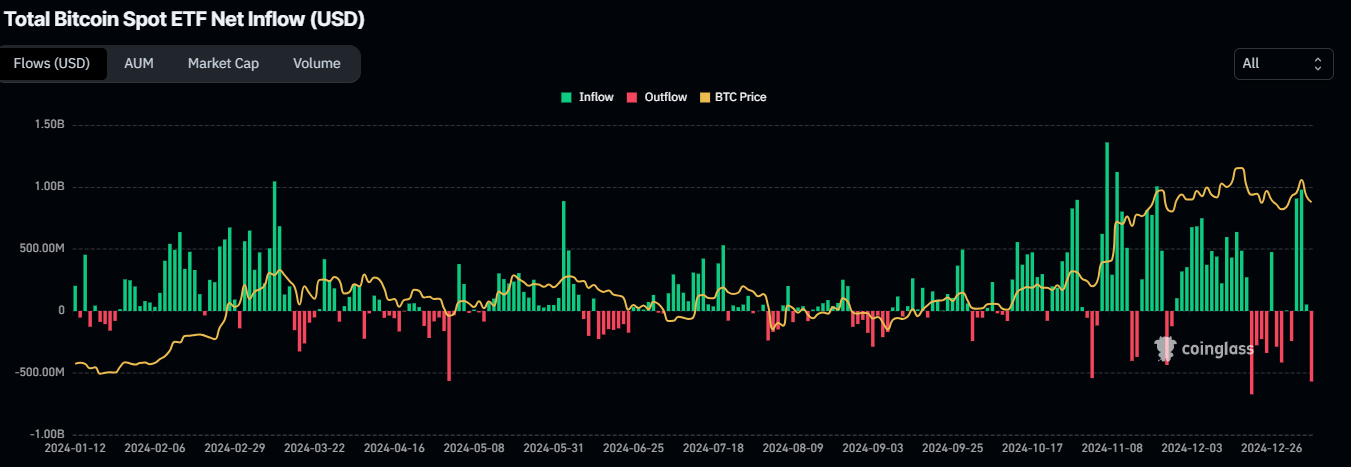

- US Bitcoin spot ETF data recorded a total net inflow of $462.2 million until Thursday.

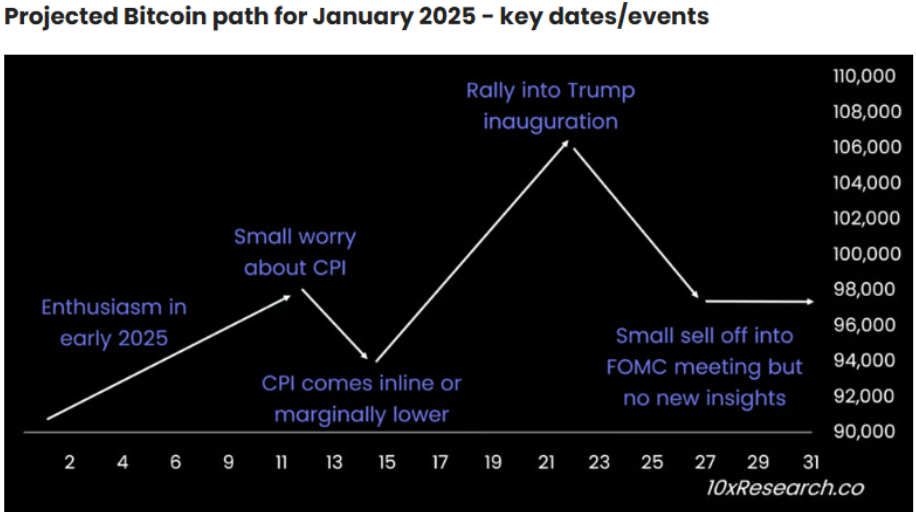

- A 10xResearch report this week highlights Bitcoin’s price action for the upcoming major events in January.

Bitcoin’s (BTC) price slightly recovers and trades around $94,700 on Friday after declining nearly 6% earlier this week. US Bitcoin spot Exchange Traded Funds (ETF) data shows signs of mild recovery, with a total net inflow of $462.2 million until Thursday. A 10xResearch report released this week projects Bitcoin’s price action for the upcoming major events in January.

Bạn đang xem: Room for a recovery or continuation of the pullback?

Michael S. Barr’s resignation announcement

Bitcoin price started the week by claiming its $100K mark and closed above $102,000 on Monday following the Federal Reserve (Fed) Board announcement that Michael S. Barr will step down from his position as Fed Vice Chair for Supervision. This announcement positively impacted the overall crypto market as Barr is known for his stringent regulatory approach towards banks engaging with and custodying cryptocurrencies. His departure is expected to ease concerns over potential harsh regulatory changes during President Biden’s final days in office.

“Barr’s resignation will officially be effective on February 28 or earlier as a successor is confirmed but will continue to serve as a member of the Federal Reserve Board of Governors,” says the Fed’s press release post.

In an exclusive interview with FXStreet, Nkiru Uwaje, COO and co-founder of MANSA, said, “Michael Barr’s resignation is being interpreted as a potentially bullish development for the crypto space, signaling that the market could be in store for a more dynamic and favorable regulatory environment.”

Uwaje further explained that over the past few years, the Securities and Exchange Commission’s (SEC) unfavorable approach to crypto policies has made it difficult for institutional and individual investors to access digital assets, creating a void in investment opportunities. As a result, both the SEC and the broader US financial system missed out on the opportunity to capitalize on the growing digital asset movement.

“A shift in regulatory tone, especially following the resignation of the Fed’s Vice Chair, may pave the way for greater institutional investment in crypto, enabling the US to maintain its dominance in global finance. However, despite this potential shift, the creation of a Bitcoin reserve would likely remain a contentious issue,” said Uwaje to FXStreet.

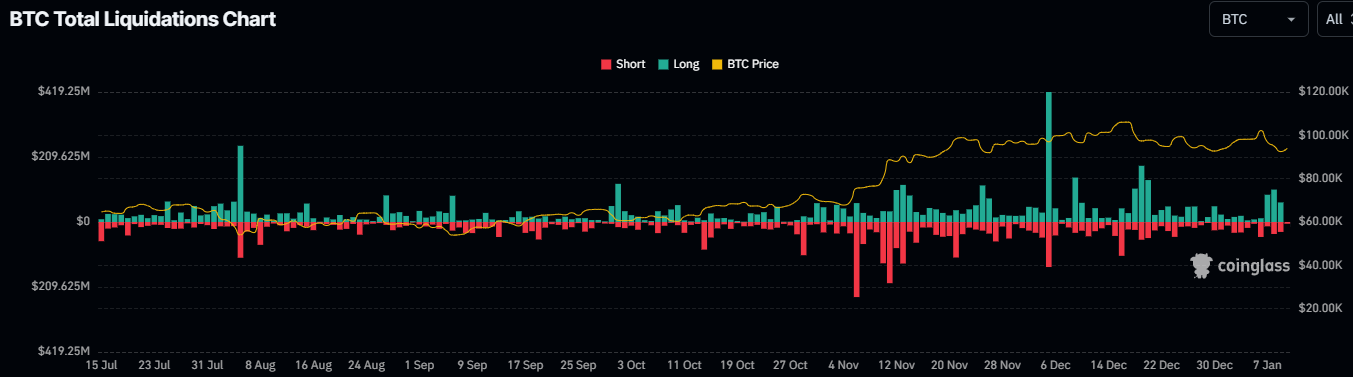

Bitcoin trader’s liquidation sweep this week

Bitcoin price could not sustain above its $100K mark on Tuesday and declined near 9.50% until Thursday, reaching a daily low of $91,203. This downturn came after the release of the US Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI) and Job Openings and Labor Turnover Survey (JOLTs) data on Tuesday, which revealed unfavorable results for risky assets. This price correction triggered a wave of liquidations across the crypto market, resulting in $1.49 billion in total liquidations in the last three days, almost $340.08 million specifically in BTC, according to data from CoinGlass.

Total Liquidations Chart. Source: Coinglass

Bitcoin Total Liquidations Chart. Source: Coinglass

Bitcoin’s institutional demand and on-chain metrics show signs of weakness

Institutional demand recovered slightly this week but remained weak, as seen in early December. According to Coinglass, Bitcoin spot ETF data recorded a total net inflow of $462.2 million until Wednesday, after a $255.2 million inflow last week. It is worth noting that the US markets remained closed on Thursday in observation of a National Day of Mourning in honor of former President Jimmy Carter. Moreover, on Wednesday, the ETF had the highest single-day outflow since December 19, of $568.8 million. For Bitcoin’s price to recover and rally, the magnitude of the ETF inflow must intensify.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

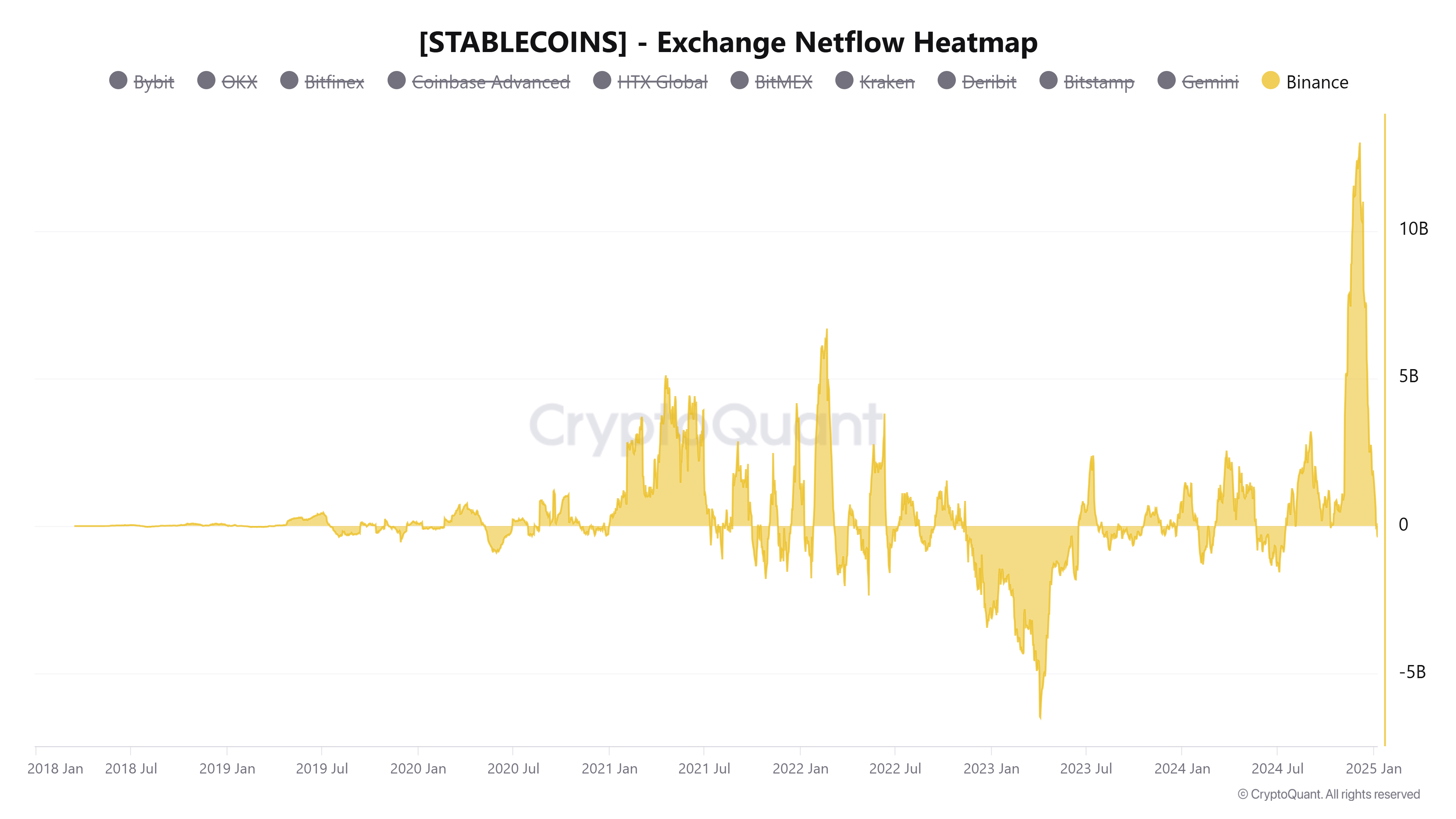

Another sign of weakness is the reversal in stablecoin flow dynamics on Binance. According to CryptoQuant’s stablecoin data, Binance’s stablecoin reserves (ERC-20) have steadily decreased since early December, from a $13 billion inflow on December 5 to a $383.2 million outflow on Wednesday. This suggests that investors may be securing their capital or locking in profits.

A similar trend reversal was last observed in May 2024, before Bitcoin’s sharp price decline from $71,900 to $64,300 in one month. If history repeats, BTC could experience a similar crash in the upcoming days.

Stablecoins-Exchange Netflow Heatmap chart. Source: CryptoQuant

Upcoming US CPI and Trump inauguration could be favorable events for Bitcoin

A10xResearch report this week highlights Bitcoin’s price action for the upcoming major events in January.

The report explains that Bitcoin could have a positive start to the year, followed by a slight pullback leading into the US Consumer Price Index (CPI) data release on January 15, as shown in the graph below. A favorable inflation print could reignite optimism, fueling a rally until President-elect Donald Trump’s inauguration on January 20. However, this momentum may wane, with the market likely retreating somewhat ahead of the FOMC meeting on January 29. Traders should remain cautious and watch for upcoming events as Bitcoin prices could be highly volatile.

Projected Bitcoin path for January 2025. Source: Coinglass

Bitcoin Price Forecast: Recovery mode or continuation of the pullback

Bitcoin’s price declined 9.47% since Tuesday and closed at $92,552 on Thursday after testing the 38.2% Fibonacci retracement level of $92,493 (drawn from the November 4 low of $66,835 to the December 17 high of $108,353). At the time of writing on Friday, BTC slightly recovers and trades around $94,700.

Xem thêm : North Korean Hackers Pull Off $308M Bitcoin Heist from Crypto Firm DMM Bitcoin

If BTC continues its pullback and closes below $92,493, it could extend the decline to test the psychological level of $90,000.

The Relative Strength Index on the daily chart read 46, below its neutral level of 50, indicating bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator also shows a bearish crossover on Wednesday, suggesting a sell signal and a downtrend.

BTC/USDT daily chart

However, if BTC recovers and closes above the $100,000 level, it could extend the rally to retest the December 17, 2024, all-time high of $108,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Nguồn: https://rentersinsurance.cyou

Danh mục: News